Is your Stablecoin on shaky ground? (Part 2)

Recently, I have been enthralled by the Netflix show, Bullsh*t and I have to say, the similarity between that game show and some of these Stablecoins is unreal.

Are some Stablecoins serving us a load of BS? We'll see…🤔

Hey there,

Welcome to the eleventh issue of 2 cents on a coin!

In Part 1 of this series, we established that Stablecoins are crypto banks - the issuers we buy them from collect our hard-earned cash and in return, we receive a crypto equivalent of that fiat money.

In this issue, I assign a rank to 5 of the popular Stablecoins based on the level of risk the issuers of these coins have taken with the reserves in their possessions.

Is your favourite Stablecoin really stable and pegged to fiat money or just a front for a smart aleck to gather funds for risky investment?

In an ideal scenario, a stable coin's dollar reserves will be held in cash in its most liquid form. However, this scenario creates no opportunity for the issuer to make a return on the cash in those reserves so there would be no incentive for such an issuer to even operate. In the traditional banking world, Banks are typically allowed to purchase “risk-free” investments like government treasury bills or low-risk investments like Money market funds. These are termed “cash equivalents” and are deemed almost as safe as cash. US banks are prohibited from generating more than 10% of their income from any other investments outside of cash equivalents. Such restrictions allow banks to make a modest return on the reserves in their custody while ensuring that the value of depositors’ funds stays largely stable.

Crypto can indeed be the wild west - there’s a lot of innovation and creativity in the space but also a no holds barred approach due to relatively low regulation.

While most issuers purport cryptocurrencies are pegged 1-1 with their fiat equivalent, in reality, issuers are only able to maintain that peg as long as the reserves they hold continue to return the equivalent of those funds. Most of the issuers hold highly risky investments that may turn out to be loss-making and eventually force the “un-pegging” of the listed cryptocurrencies from their fiat equivalents.

The Stablecoin Rank

From the safest to the riskiest, here’s my 2 cents on these popular Stablecoins:

#1 - USDC - Low Risk 🟢

On the top of my list of stable, Stablecoins is USDC. The issuing company’s motto is “Crypto that’s held to a higher standard”, and I agree.

100% of all USDC in circulation, all $43 billion of it are held in cash and short-term US government securities, the oldest of which matures in January 2023. A reputable independent auditor, Grant Thornton provides a monthly attestation of the validity of these claims (See proof of funds in latest report)

#2 - BUSD - Low Risk 🟢

Second, comes BUSD, provided by the top crypto exchange, Binance. BUSD reserves are also 100% cash and US government securities. However, Binance and Circle (the company which issues USDC) have invested in different government securities. While the latter’s reserves are mostly in Treasury bills, Binance’s are mostly in government securities called “reverse repurchase agreements” (repos)

#3 - USDT - Medium Risk 🟡

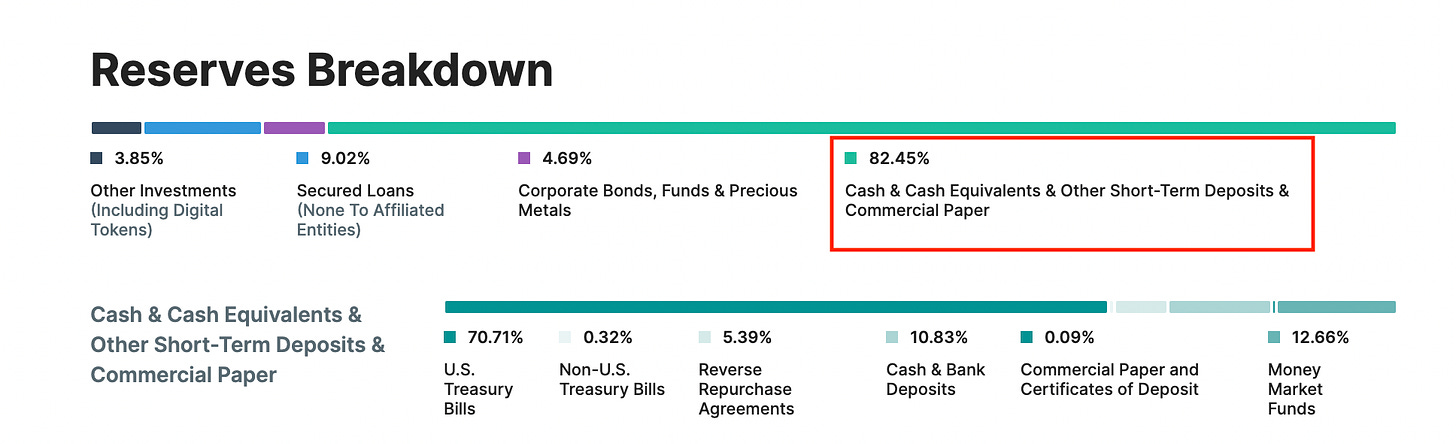

Issued by Tether, this Stablecoin can currently be exchanged 1:1 to the US Dollar. It is the oldest and most popular Stablecoin in the world. However, the risk level of this coin is not low because the issuers have invested close to 20% of the reserves in medium to high-risk securities including other cryptocurrencies. This means the value of your USDT could depreciate by up to 20% against the Dollar if those high-risk investments go bust.

#4 - USDD - High Risk 🔴

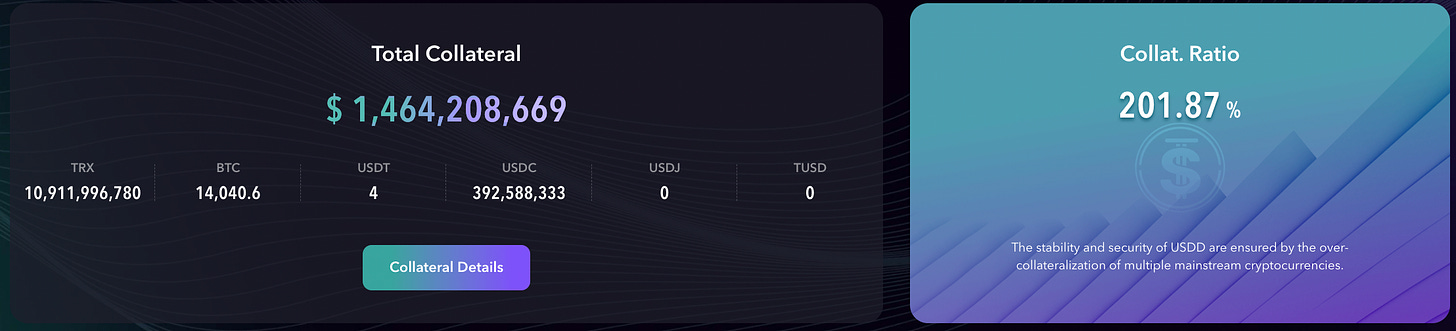

USDD is a cryptocurrency that claims to be pegged to the value of the US dollar. This means that each USDD coin should be worth the same as one US dollar. USDD is a risky Stablecoin because although it claims to be over-collateralized, with more funds in the reserve than are available in USDD, the value of the coin could still drop against the dollar. This is because only half of the reserves backing USDD are in cash/cash equivalents, with the other half being in other cryptocurrencies. These crypto assets are subject to market fluctuations, and if their value were to drop, it could cause the value of USDD to drop as well. i.e If Bitcoin and other cryptocurrencies were to lose their value today, your 200 USDD which you bought for 200 dollars could be worth 100 dollars.

Furthermore, those reserves which are backed by cash/cash equivalents are only backed by proxy. USDD holds half of its reserves not in hard $$ cash or in US government treasuries but in USDC which is just another reason to hold $$ in USDC instead.

#5 - Dai - High Risk 🔴

Note that Dai holders could be at risk of a haircut, whereby they do not receive the full value of their Dai holdings at the Target Price of 1 USD per Dai

- Dai

Enough said. Dai is not the dollar’s digital equivalent. It’s a convoluted scheme pretending to be a Stablecoin. Hodl at your own risk.

If you liked this issue of 2 cents on a coin, please share it with your friends: