Hey there,

Welcome to the eighth issue of 2 cents on a coin!

Today, my 2 cents are on Coinrule, the crypto platform on a mission to help everyday people with no coding knowledge or trading experience make automated crypto investments.

Recently, I was at a crypto meetup in Mexico City that brought together all sorts of people - from the chronic nerd who used 16 Bitcoins to “wipe his arse” back in 2015 to the grandma looking to make one last quick buck for a more secure retirement life. Everybody there had a unique story of how they came to be crypto-enthusiasts. Some had the most exciting stories.

This was where I met Rogelio Sada, Co-Founder & CEO at Ridian. I caught myself thinking: “these guys are going to raise good funding” after listening to his introduction. He talked about himself and his co-founder, their backgrounds in quant-investing, and the company they just founded - Ridian. Ridian’s product pitch is simple, a crypto-investing platform that makes automated investments on your behalf, and yet profound because even today’s big exchanges do not yet offer such services.

Binance, for example, has a feature called “Auto-invest” which allows the user to set rules that will trigger a purchase of a particular coin on a daily, weekly, or monthly basis.

This is great but has 2 handicaps. One, what if you don’t know what coins to actually auto-invest in? The traditional stock market has lots of index funds (aka ETFs) that take some of the uncertainty and risk away from investing. For example, investing in the S&P 500 is making a bet that the world’s top 500 companies will continue to grow — and that’s a pretty solid bet. With Binance’s auto-invest feature, you’d need to decide for yourself which coins to invest in. If one of the top 10 coins today falls to #50, your auto-invest button will continue to purchase that coin on Binance ad infinitum until you manually correct it. Two, the auto-invest feature only allows you to buy, you cannot sell automatically based on your pre-defined rules. Sure, the stop-limit feature offers this. i.e with a stop-limit, one can set a defined price at which to sell certain crypto assets. However, this is cumbersome and not tied into the auto-invest feature. So you’d have to pick one on Binance: do you want to auto-buy or auto-sell. You can’t do both.

With new solutions like Ridian, much of this burden is eased. Ridian is working on 3 products, the first of which will allow users to invest automatically in crypto’s top 10 coins. E.g if I enrol in the first plan, Ridian’s algorithm looks for the coins with the biggest market capitalization and invests my allocated funds. If the coin rankings change, the platform will automatically sell any coin which dropped from the top 10 and auto-invest in the new top 10. I think this is an interesting product but it is not live yet. (Join their waiting list to be first to know when it goes live)

So I decided to research more into this - surely this idea is not unique to Rogelio, some other entrepreneur must have built it? I was right. That’s when I found Coinrule, a company of 12 building a similar product in a timezone 6-hours ahead of Mexico City - London.

Coinrule

Coinrule’s mission statement; Coinrule empowers traders to compete with professional algorithmic traders and hedge funds. No coding required.1

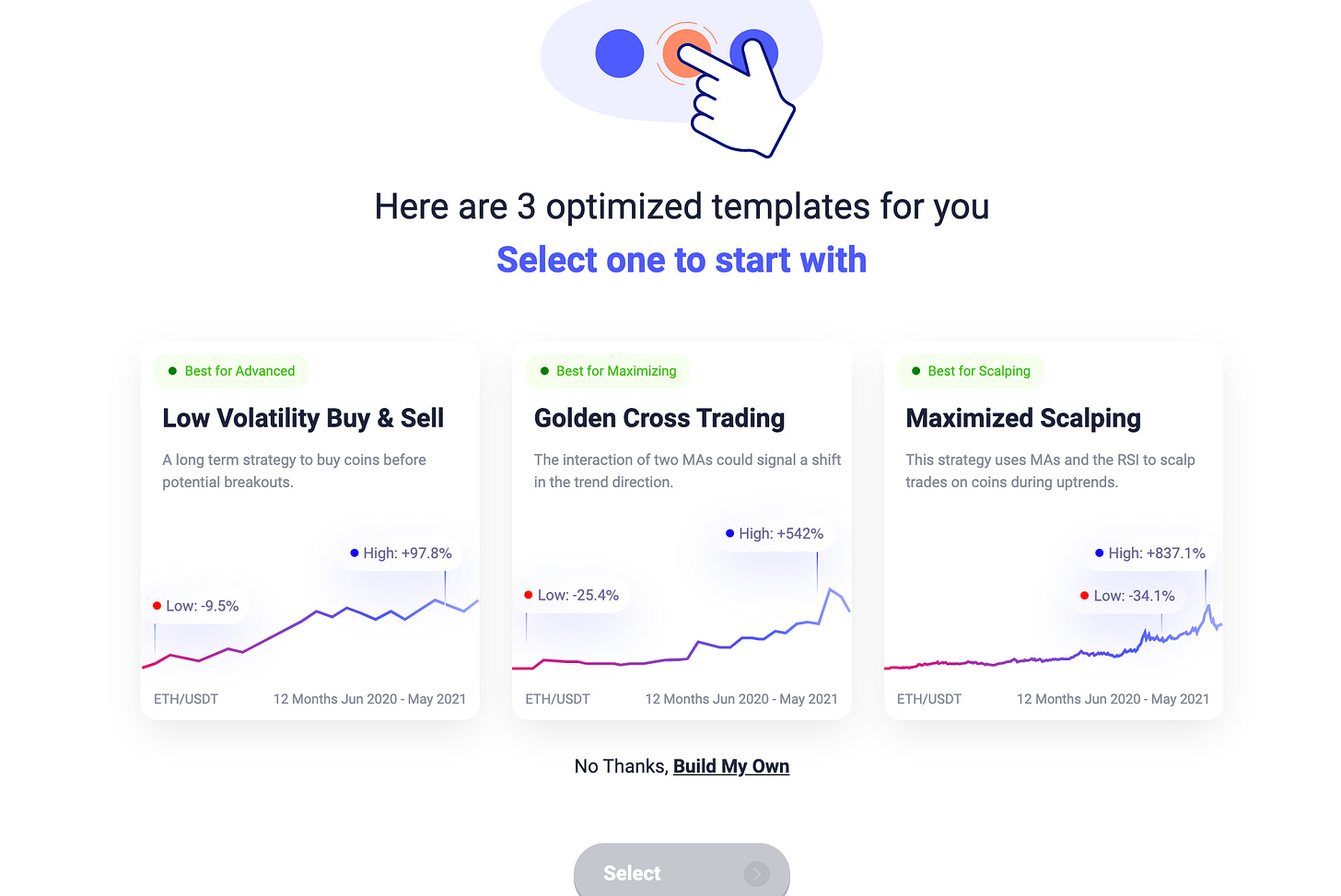

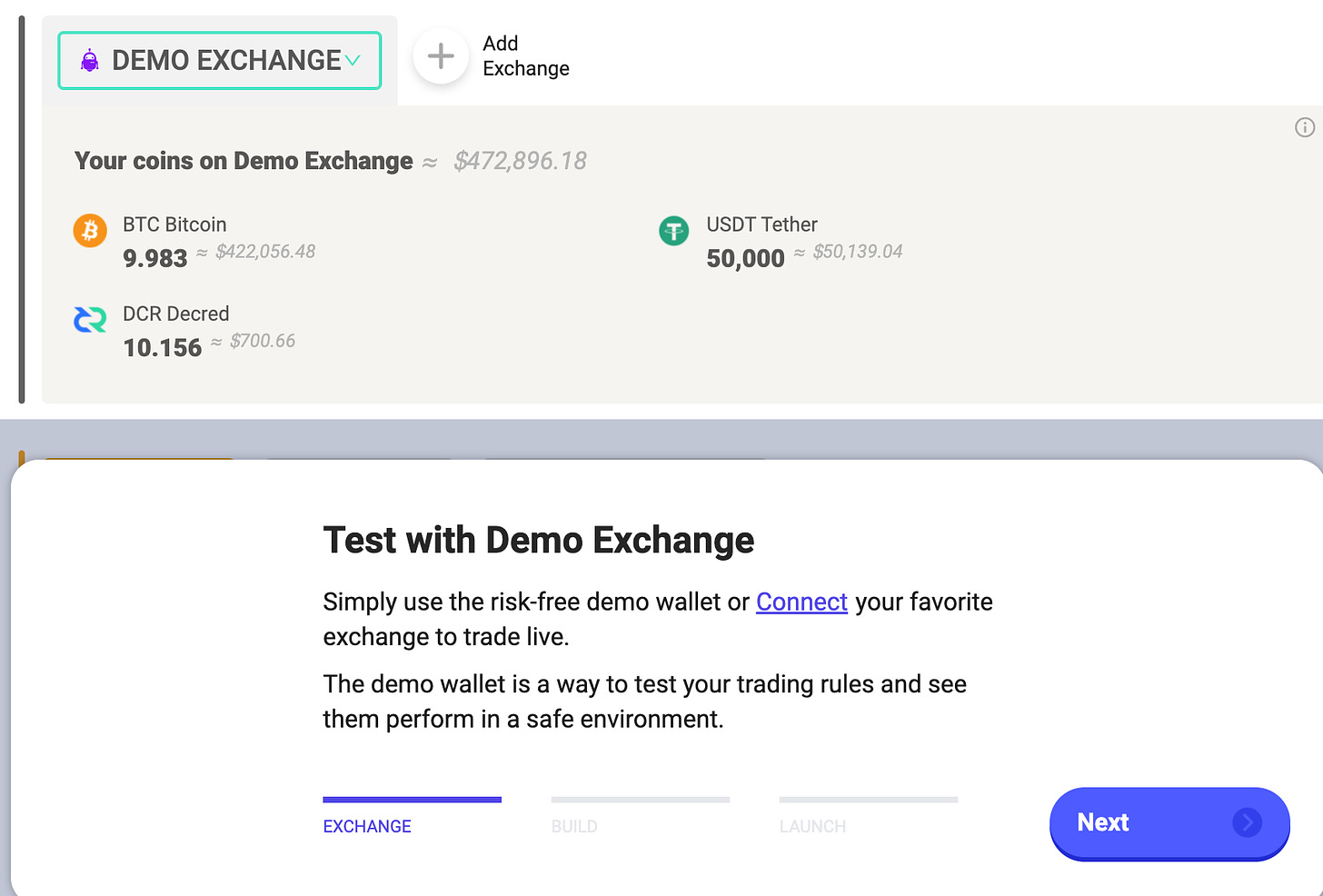

In other words, the company is making available trading bots, traditionally only available to professional traders & institutions, to the public. I signed up on their platform and think the flow is pretty user-friendly. There is even an option to test the waters without using real cash by setting up a demo exchange.

Coinrule’s traction

The market for crypto trading bots is quite nascent. Apart from Coinrule, a few other similar companies exist Shrimpy, Mudrex, Trality, each providing access to automated trading with slightly different pricing plans and value proposals.

Coinrule in particular had a pretty impressive run in 2021. The team got accepted into Y-Combinator and raised $2.2 million dollars to double down on expansion and business growth. The platform reports it has 13,000 users trading assets worth £100m every month.2

Drawbacks

No index funds: Unlike in traditional stock markets, many of the centralized exchanges and automated trading platforms, including Coinrule do not yet have index funds - a basket of cryptocurrencies gathered according to certain characteristics. You’d still need to invest in cryptocurrencies singularly. It’d be great for users to have opportunities to invest in various baskets in one go: e.g GameFi, DeFi, top 10, top 50 the way one can invest in ETFs on stock exchanges. One index fund for the top 10 cryptocurrencies exists in the traditional stock market: Bitwise 10 but again, no such equivalents are available on the blockchain. This was one differentiating value Ridian plans to bring to the table.

Security: All platforms offering trading bots need to plug into your wallet in your decentralized exchange. Since this is an additional point of failure and interest for hackers, connecting external platforms to your exchange wallet poses extra security risks. However, Coinrule has set up checks to ensure the security of the connection. In addition to having no authority to withdraw funds from your wallet, communication to the wallet through Coinrule’s API is encrypted.

In summary,

As the crypto market matures, it’s inevitable that more sophisticated financial products will be built on top of the existing infrastructure. Trading bots, index funds, Coinrule or Ridian, entrepreneurs who devise methods to fill this gap will build the highly valuable companies of the next decade. I’m rooting for Coinrule…and Ridian, both with strong founders & teams already in the running to bring this value to the crypto-world.

Would you invest 2 cents with Coinrule, yes or no, and why?

Please leave a comment below.

https://coinrule.com/

https://www.uktech.news/news/london-automated-crypto-trading-platform-coinrule-20211001