Hey there,

Welcome to the sixth issue of 2 cents on a coin!

Today, my 2 cents are on Crypto.com Coin (CRO), the exchange aiming to put a cryptocurrency in every wallet.

If you are wondering why the $100 you invested in October last year is now $20, you are not alone. This month, Bitcoin has lost more than 40% of its last peak value during what is the highest sell-off in 2 years. The market is constantly swinging between irrational excitement and irrational fear. In peak season (a bull market), more people are buying more coins and the mood is optimistic. During the off-peak periods (a bear market), people are selling and the mood is pessimistic.

The bear market may be upon us but as long as there is any buying or selling of cryptocurrencies, cryptocurrency exchanges remain in business.

Think of your favourite supermarket - Spar, Tesco, Walmart? What makes you choose to shop there? Do you like the variety of options, low prices, or is it just in the most accessible & convenient location for you? Most likely, your answer is a combination of those three reasons. Cryptocurrency exchanges are just like your supermarket - you choose them if they have a variety of cryptocurrencies, low transaction fees and are accessible and easy to use — but they are also like your village market, and your local bank. At your average Tesco, you can buy a carton of juice and biscuits but cannot come back to sell them. Tesco only sells you stuff, they don’t buy them from you (they will only buy from approved suppliers - wholesalers, or the manufacturers themselves) A cryptocurrency exchange will buy cryptocurrencies from you even at small units. In this way, they are like a village market - you can go there to buy and sell. In addition to being market makers, exchanges also act as banks. Back to Tesco: if you bought that carton of juice and biscuits, you’d be expected to take them home. What if you wanted to go hiking and didn’t want to inconvenience of carrying heavy groceries on your journey, could you store them in a designated location at Tesco’s warehouse? Nope. You can do that with your coins on crypto exchanges - usually for free. You could even earn interest on top of those coins you deposited if you agree not to withdraw them for a certain period — making them available for the exchange to loan out to others. So a supermarket, a village market & your bank - most crypto exchanges wear these 3 hats.

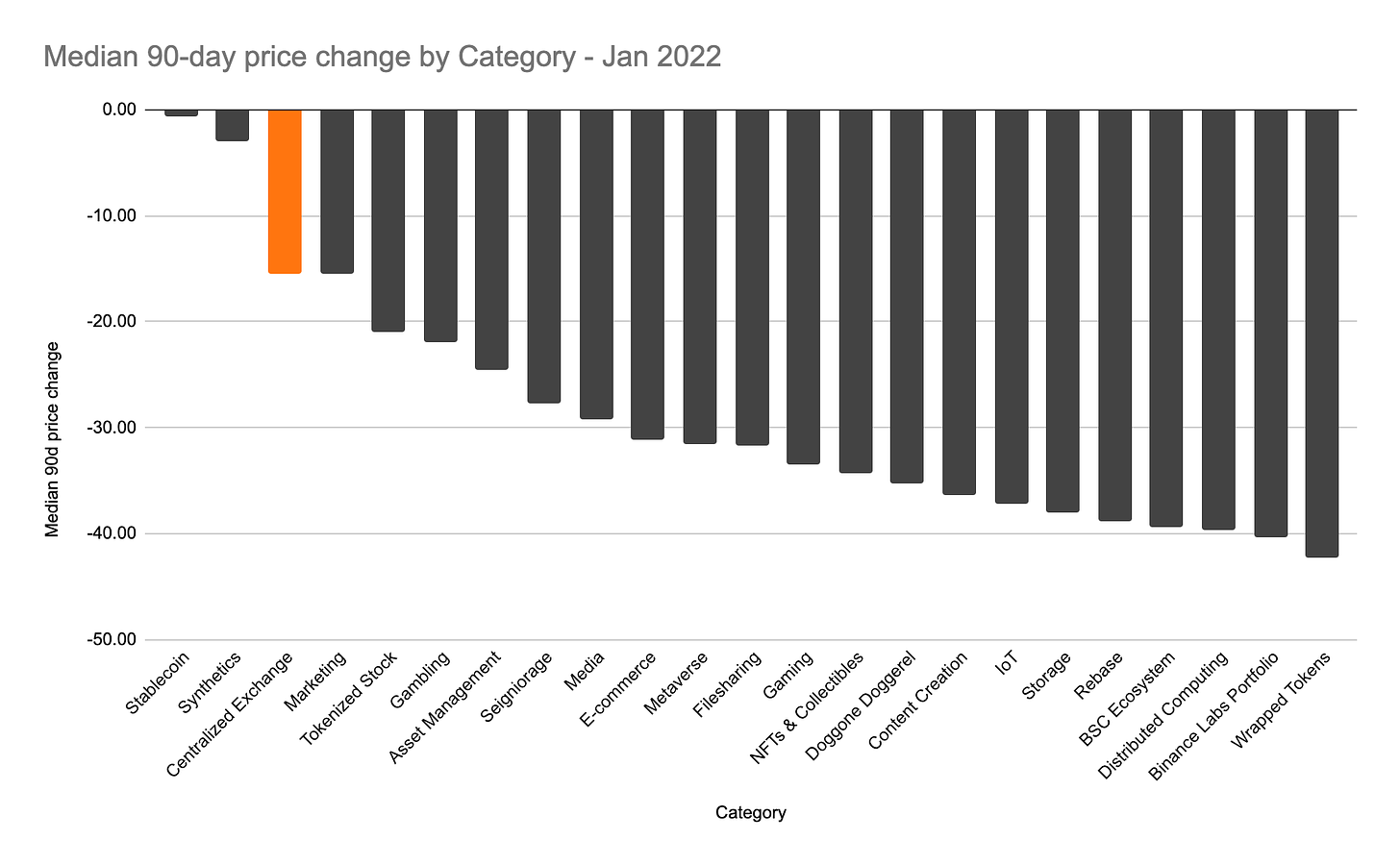

This is why exchange coins are one of the least volatile in every season - whether bull or bear. As long as there are transactions happening, your favourite crypto exchange remains in business. All categories of cryptocurrencies have seen a decline in the average price of coins in their basket, driven by the sell-off in the past few weeks. However, coins of Centralized Exchanges on average, have not dipped as low as most others.

Coins in the Centralised Exchange category on Coinmarketcap have dipped by 15% on average in the past 3 months, a slower decline compared to other categories like Metaverse and Gaming which have both declined by more than 30% on average in the same period.

So we have established that Centralised Exchanges will continue to be in business as long as you visit them to buy, sell or store your cryptocurrencies. Now introducing Singapore-registered centralised exchange, Crypto.com. 🥁

Crypto.com

Crypto.com was founded in 2016 as Monaco. The company renamed itself Crypto.com in 2018 after purchasing this domain from University of Pennsylvania professor, Matt Blaze.

Crypto.com wears the three crypto exchange hats - supermarket, village market, bank. The exchange can be accessed on the web & mobile app for buying & selling cryptocurrencies. In addition, it offers a suite of banking services from custodial to payments, savings interest, and loans.

Why is my 2 cents on Crypto.com today? Amongst all the centralised exchanges, crypto.com has had the best performance in the last 3 months. For a crypto market that is in the low season, this coin is definitely weathering the storm.

With the recent heavy investments in marketing, Crypto.com’s price growth is not a surprise. In November 2021, Crypto.com and AEG, the world’s leading sports and live entertainment company, launched a 20-year naming rights agreement that will rename the AEG-owned and operated STAPLES Center, one of the most iconic and globally recognized sports and entertainment arenas in the world. Effective December 25 2021, the multi-purpose arena, which serves as the official home of the NBA’s Los Angeles Lakers and LA Clippers, the NHL’s LA Kings and the WNBA’s Los Angeles Sparks, will be known as Crypto.com Arena.1 This deal is said to be costing Crypto.com $700 million.

In October 2021, the company also unveiled a commercial starring popular actor, Matt Damon:

Although this commercial is now the butt of some jokes on the internet, a marketing stunt like this with such a high profile actor has no doubt increased awareness of the exchange in the past months.

CRO’s marketplace performance

1. 3-month price change: Of the top 12 coins in CoinMarketCap’s Centralized Exchange category (excluding those with fewer than 20 market pairs), CRO ranks #1 by the 3-month price change, before Gate token of gate.io.

2. Volume: At the time this data was pulled on 23.01.2022, CRO had the third-highest volume in trades in the Centralized Exchange category, after BNB & FTX Token- about $200 million in transactions within 24 hours. This speaks to the level of interest in the exchange & correspondingly, its native coin which attracts lower trading fees on the platform.

3. Unique value proposition: Just like a supermarket, an exchange’s value proposition must be in the number & variety of “goods” (coins) it has on the shelf and the price of those “goods” relative to other stores. Because crypto exchanges also operate like banks - storing funds and offering all sorts of financial services, their value proposition vs competing exchanges must also be measured in relative interest rates as well as deposit/withdrawal fees.

Choice: Crypto.com boasts over 100 coins but is still lagging behind Binance/Gate.io which both support trading of more than 500 coins.

Price: Price in this case is a proxy for trading fees. Each coin on an exchange has its price which is determined by the supply and demand of those coins. In addition to the base price of the coin, exchanges charge a trading fee when you buy/sell on their platforms. The lower the trading fees, the better the value proposition to users. Fees on Crypto.com are as high as 0.40% which is 4x higher than Binance’s 0.10% for similar trade volumes.

Interest rates: The higher the interest rate on staked (deposited) coins and the lower the rates on loans on the exchange versus others, the more attractive the platform is to both savers and borrowers.

USDT interest rate: Currently Crypto.com offers up to 12% return on staked USDT per annum, much higher than 7% which Binance is offering. (Interests rates offerings constantly change across platforms)

Interest on Loans: Crypto.com has currently set its interest rate at 12% per annum. (8%, if you have up to $40,000 worth of CRO deposited) Compared to Binance’s 16% per annum, the former’s interest rates are definitely more appealing to borrowers.

Overall, Interest rates on Crypto.com are quite attractive, especially when compared to other offerings in the market.

Drawbacks

1. Security: Every online exchange has a phobia: getting hacked. This event unfortunately materialised for Crypto.com on January 17 2022 in an incident that compromised the accounts of 483 users and led to a total loss of $30 million worth of cryptocurrencies. The company announced on 20th January 2022 that it has reimbursed all stolen funds to users and has now introduced the Worldwide Account Protection Program (WAPP) which will reimburse up to $250,000 to qualified users should something similar occur in the future. Although the hacking of crypto exchanges is nothing new, similar events have led to the collapse of exchanges in the past.

2. Value proposition: Overall, Crypto.com still has a lower value proposition than exchange giants, Binance & Coinbase with 4x higher trading fees vs Binance & 3 times fewer coins to buy/sell.

In summary,

I think the CRO token could become even more valuable in the next 12 months if:

1. User base on Crypto.com continues to grow. The company currently reports a customer base of 10 million accounts, about one-third the number reportedly using Binance.

2. No further exchange hacks occur. Crypto.com must tighten up the platform’s security to maintain growth.

3. There’s continued investment in raising awareness of the exchange while maintaining a good value prop to users.

Would you invest 2 cents in CRO, yes or no, and why?

Please leave a comment below.

https://www.aegworldwide.com/press-center/press-releases/aeg-and-cryptocom-lead-future-creative-capital-sports-music-and