Hey there,

Welcome to the seventh issue of 2 cents on a coin!

Today, my 2 cents are on KuCoin (KCS), the crypto exchange which claims to serve 1 out of every 4 crypto holders worldwide.

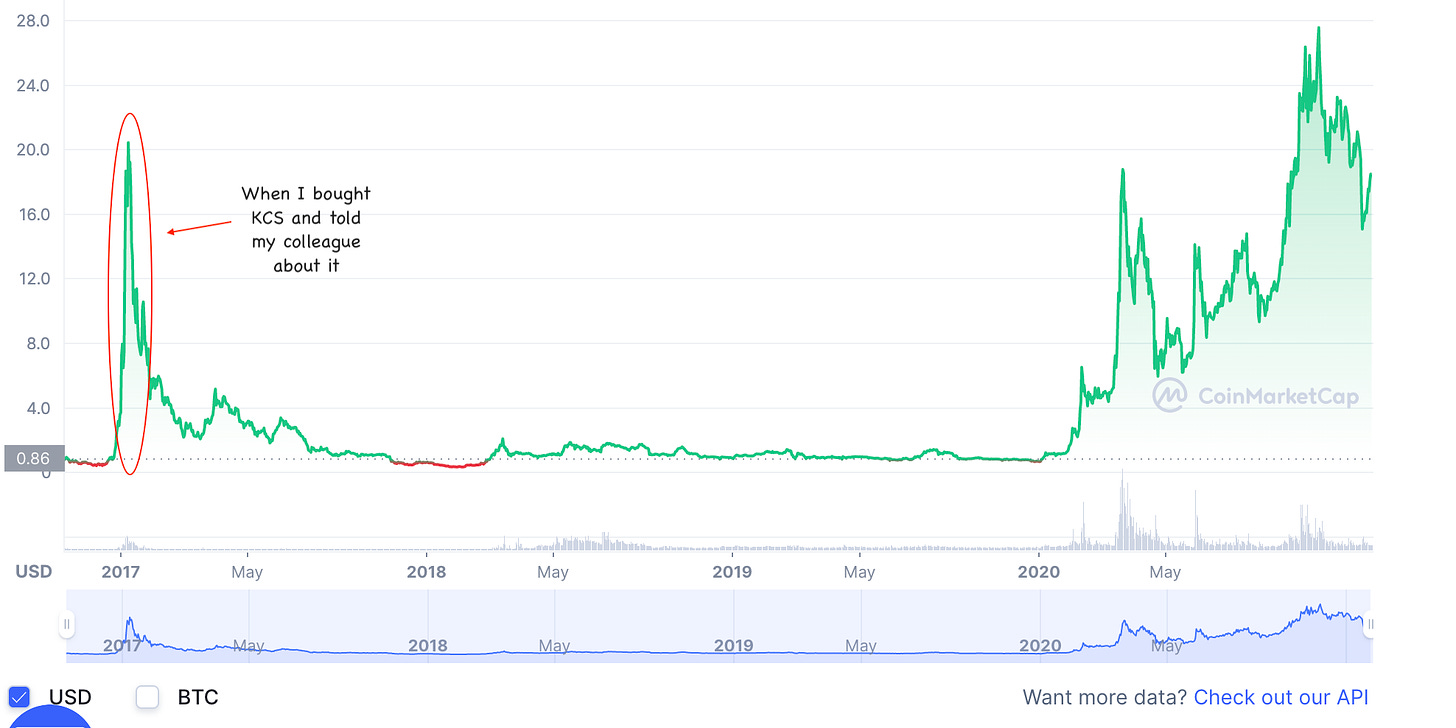

In January 2018, I told a colleague of mine who was crypto-cautious about KuCoin and the fact that I had just bought about 5 KCS. If there was a good token to buy to get his feet wet in crypto, this was it, I said. He bought his first cryptocurrency - KuCoin, then the price crashed some days later. 🙉🙈🙊

So in case you didn’t know - my articles are not financial advice. I aim to share with you my research on one cryptocurrency per week and provide educational, and I dare say, entertaining crypto content which I hope will supercharge your interest in this fascinating space.

That 5 KCS 5.6862 KCS I bought back in 2018 is still there, sitting pretty. If I added an extra 0.32 to make it up to 6 KCS, I’d have benefitted from the exchange’s bonus plan which distributes 50% of daily trading revenues to all accounts holding at least 6 KCS. I could also have sold it and invested in BNB which has performed better over the same period. But it’s all water under the bridge. Finance 101 says we should diversify our portfolio so let’s move on.

So why KuCoin today?

KuCoin’s token, KCS may not have done as well as BNB, the token of the Binance exchange which was launched in the same period in 2017. However, the KuCoin exchange and its token, KCS, have certainly outperformed dozens of other centralized cryptocurrency exchanges.

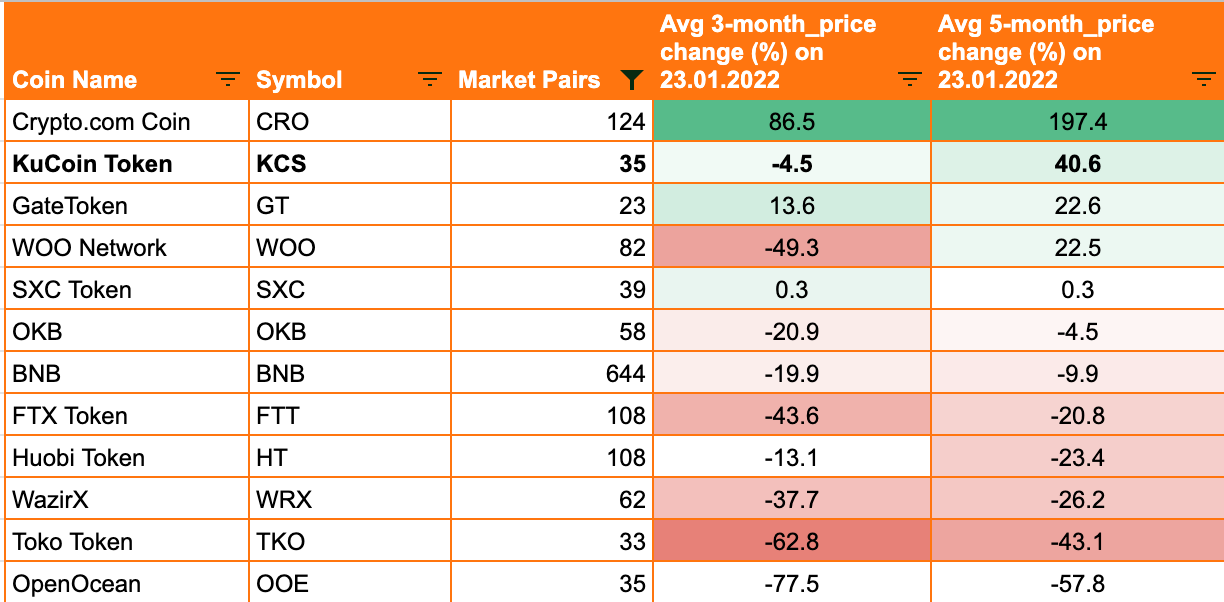

Believe it or not, CoinMarketCap lists 76 coins tagged as centralized exchange tokens. Many of these are names you have never heard about so I have devised a method to cut out the laggers - all tokens with less than 20 market pairs are deemed unworthy of further analysis in my operating manual. This filter leaves us with 12 tokens. In the last 5 months, KCS outperformed all other exchange tokens except Crypto.com coin. (See my 2 cents on Crypto.com here)

Introducing KuCoin… 🥁

KuCoin

As I shared in my last post, you can think of centralized exchanges like a supermarket, a village market, and a bank, and KuCoin fits this mold to a “t”.

KuCoin was launched in September 2017 and has since grown to be one of the top exchanges in the world. Today, the platform offers up to 600 coins for trading to over 10 million people. In addition, there is a suite of banking services from custodial to savings & loans. Currently, the exchange offers an Annual Percentage Yield (APY) of 8.9% on USDT savings and much higher guarantees up to 100% per annum on other coins. Although much higher returns are promised for other coins, it helps to carefully study the project and determine whether the value of the coin will rise or at least remain the same over time. Imagine a scenario where you buy and hold (a.k.a stake) 2 dollars in a coin which is selling at $0.5 per coin in January 2022. You just acquired 4 units of that cryptocurrency. With a guarantee of 100% APY, you’d receive 4 extra units of that coin after 1 year, in January 2023, adding up to 8 in your portfolio. This looks great on paper but if 1 unit of that coin falls from $0.5 to $0.1 in the same period, the value of your 8 units will be $0.8, less than half of the $2 invested at the start of the year. Because USDT is pegged to the dollar, its price is quite stable throughout the year and is equivalent to 1 USD so staking in USDT is the least volatile investment one can make on crypto exchanges. Conversely, staking your funds in a coin that appreciates in value & also has a guaranteed APY provides an even higher return on investment than the exchange offered.

KuCoin claims that 1 out of 4 crypto holders is with KuCoin but according to Crypto.com’s most recent market sizing report released in Jan 2022, crypto adoption increased to over 295 million users in December 2021. At the same time, KuCoin says it has 10 million users so the math doesn’t add up. 🚩

KCS’s marketplace performance

1. 3-month price change: Of the top 12 coins in CoinMarketCap’s Centralized Exchange category (excluding those with fewer than 20 market pairs), KCS ranks #2 by the 5-month price change, before Gate token of gate.io.

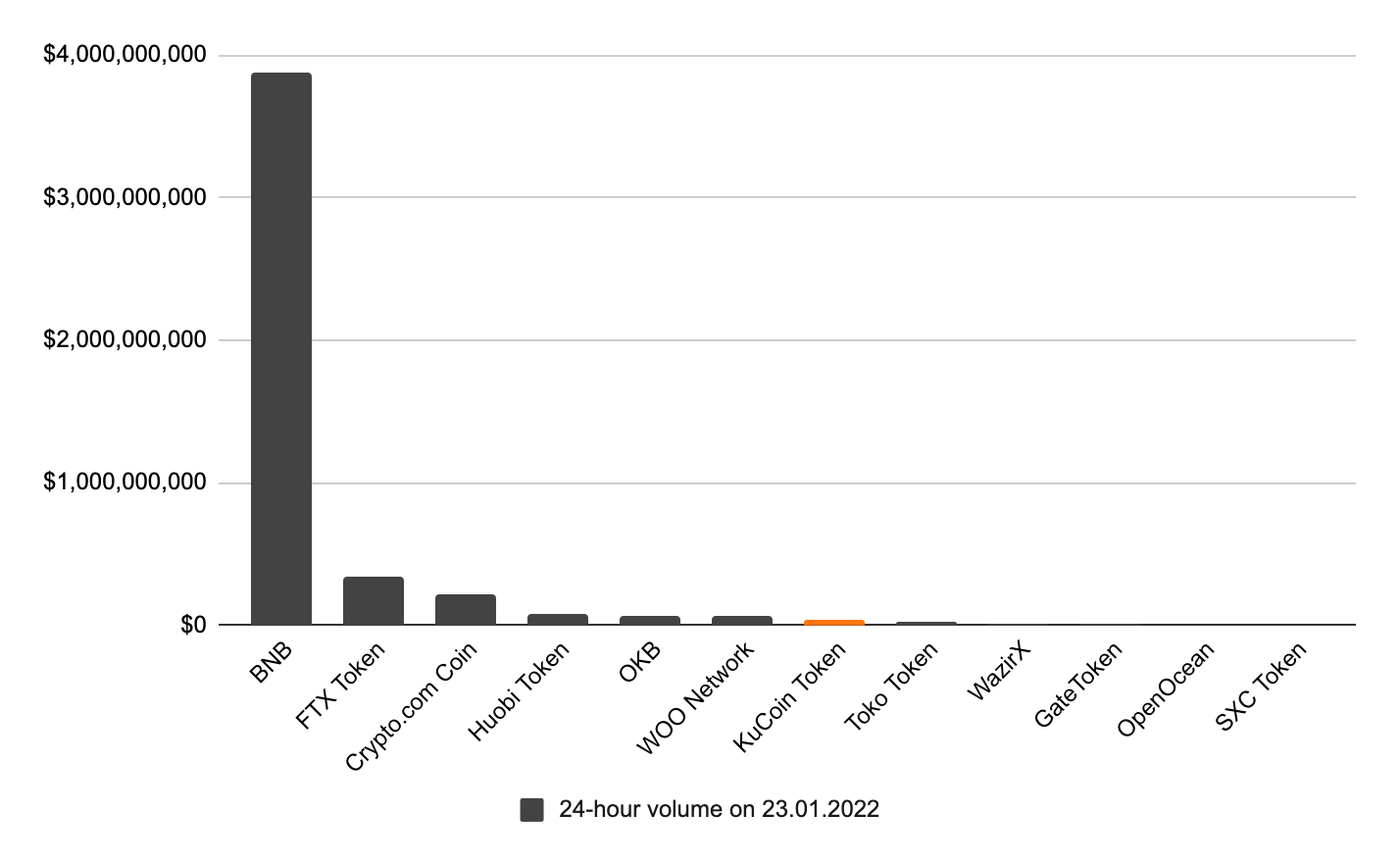

2. Volume: At the time this data was pulled on 23.01.2022, KCS had the seventh-highest volume in trades in the Centralized Exchange category, after BNB & FTX Token - about $32 million in transactions within 24 hours speaking to a relatively low level of interest in the exchange’s token.

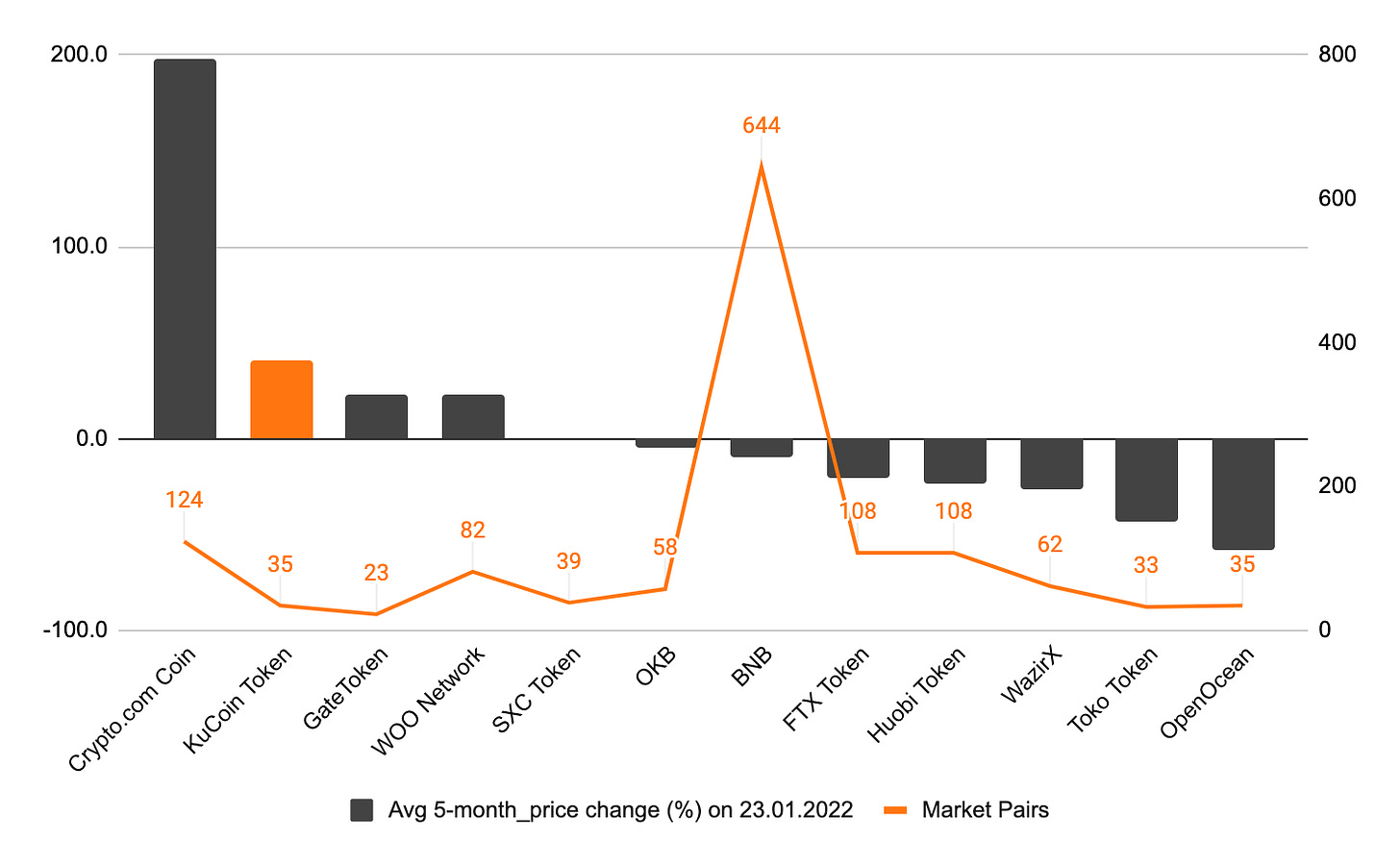

3. Unique value proposition: At 7th position by volume, KCS token is not attracting as many transactions as BNB, FTX, Huobi token, etc, but it has gained more in value versus these coins in the last 5 months. KCS volume is relatively low because it has fewer market pairs (35) compared to other tokens. For example, BNB has 644 pairs and Huobi, 108. However, its price has risen relative to most others because the volume of trades on KuCoin has actually also risen relative to many other exchange tokens in the past 5 months. We can attribute KCS price increase to their strong value proposition with trading fees (0.1% for most accounts and as low as 0.01% for high-value traders) & staked earnings.

Drawbacks

1. Choice: Although there are more than 600 coins available on KuCoin, trading pairs with KCS are few. i.e KCS cannot be traded directly with more than 35 other coins which means the benefit of discounted trading fees (up to 20% less) which apply when trading with KCS is limited.

2. Regulatory issues: Regulatory clarity is largely missing in the crypto space and many crypto establishments have had a run-in with national authorities. Crypto is explicitly banned in China and 8 other countries. However, KuCoin seems to be hit harder than most others, perhaps on the same level as Binance but with poorer agility in responding to these regulatory issues. In June 2021, Canada announced a crackdown on crypto exchanges including KuCoin which are deemed as non-compliant with local regulators.

3. Reputation: KuCoin seems to have a more drab reputation compared to its counterparts. Perhaps if they made effort to aggressively report the scam accounts circling the internet and waiting to collect unsuspecting users’ KuCoin login details, this will help. I was amazed at the number of false, phishing websites that popped up even as #1 on Google when I searched “Kucoin”

Beware of false websites like this. Their landing pages are exactly like the real one but only to collect login details for illegitimate access to your precious account.

In summary,

I think the KCS token could maintain its current price range but will not rally significantly in 2022 if it is unable to offer better trader value proposition & navigate regulatory challenges. One big benefit KuCoin offers is the daily dividend of 50% of the exchange’s earnings distributed to holders of at least 6 KCS.

Would you invest 2 cents in KCS, yes or no, and why?

Please leave a comment below.